Renters Insurance in and around Plainfield

Plainfield renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

- Plainfield

- Naperville

- Bolingbrook

Home Is Where Your Heart Is

Trying to sift through providers and deductibles on top of keeping up with friends, family events and managing your side business, can be overwhelming. But your belongings in your rented house may need the incredible coverage that State Farm provides. So when trouble knocks on your door, your sports equipment, linens and appliances have protection.

Plainfield renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Protect Your Home Sweet Rental Home

You may be doubtful that Renters insurance can actually help protect you, but what many renters don't know is that your landlord's insurance generally only covers the structure of the home. What would happen if you had to replace your valuables can be substantial. With State Farm's Renters insurance, you have a good neighbor who can help when unexpected mishaps occur.

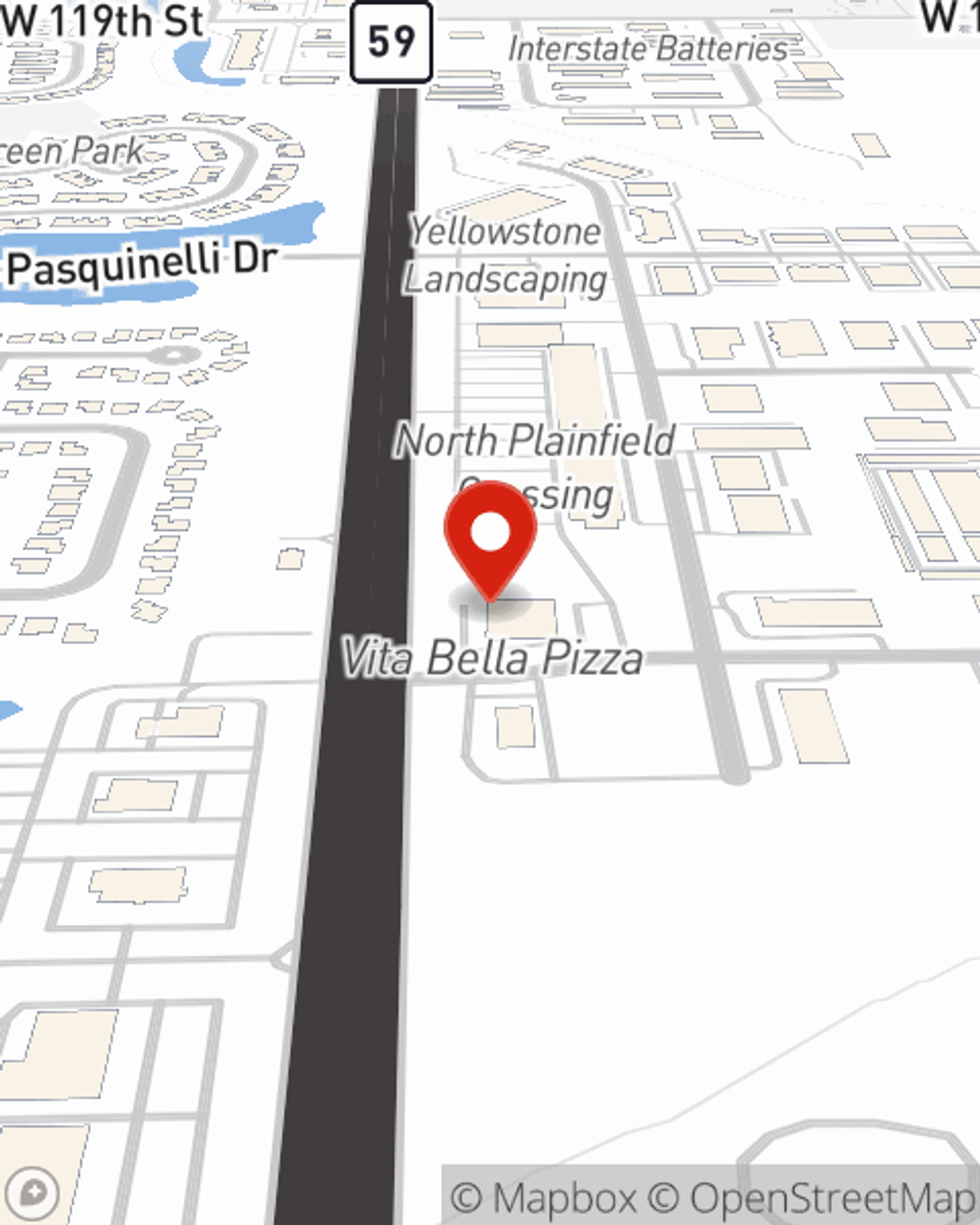

As a trustworthy provider of renters insurance in Plainfield, IL, State Farm aims to keep your belongings protected. Call State Farm agent Chris McLeod today and see how you can save.

Have More Questions About Renters Insurance?

Call Chris at (815) 609-9099 or visit our FAQ page.

Simple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.

Chris McLeod

State Farm® Insurance AgentSimple Insights®

Insurance and other tips for college students and their belongings

Insurance and other tips for college students and their belongings

Learn how your homeowners insurance policy can help protect your college student and their belongings while they are living in a residence hall or dorm.

What are the different types of insurance?

What are the different types of insurance?

You can have more coverage than just car insurance, homeowners insurance, and life insurance. Learn about options for these and other types of policies.